The COVID-19 pandemic was absolutely brutal for just about any industry that relies on people being able to interact with one another in-person. As a result, the exhibition side of the movie business suffered in a big, bad way, with most theaters closed in the U.S. for months on end during 2020. From March until August, it was a complete ghost town. Even when big movies like "Tenet" and "The New Mutants" arrived, things didn't truly begin to pick up until the end of the first quarter of 2021.

However, things have been looking up in a major way in 2022, with the box office on track to far exceed 2021. Many analysts believe 2023 will be even brighter. That means things have improved for the nation's two largest theater chains, AMC Theatres and Regal Cinemas. But the outlook, in the long run, may not be the same for both companies as AMC has managed to rebound a bit better than Regal has.

The Recovery For AMC Vs Regal

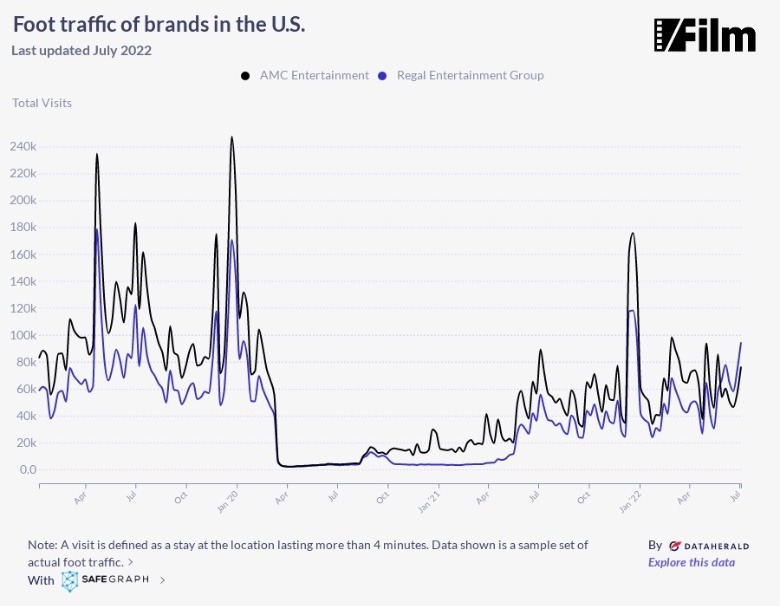

As you can see, the chart above shows us an important metric to use as a jumping off point for these two cinema giants: how much foot traffic each theater chain receives. Throughout 2021 and for most of 2022, AMC has been dominating in that department, particularly through the first half of 2021 and January of 2022, likely thanks to "Spider-Man: No Way Home." Though it is worth pointing out that Regal gained a slight edge in foot traffic in recent months, which may well have to do with the success of "Top Gun: Maverick" and, in this case, the chain benefiting more from impulse viewings while people are out and about. That is somewhat speculative, but June and July have been powered by major releases including, "Maverick," "Jurassic World Dominion," and "Minions: The Rise of Gru."

Granted, this is just one metric and there are many things to consider when it comes to both companies here. However, it does work as a good springboard for a larger conversation and this data tells us that AMC has had a steadier recovery than Regal. And digging in further, that does indeed seem to be the case well beyond foot traffic.

Regal Cinemas

Regal currently operates around 6,787 screens in 505 theaters in the U.S. Crucially though, they are owned by a parent company, the U.K.'s Cineworld, and that company has been facing some major challenges in trying to climb out of the hole that the pandemic created. In particular, legal action and other financial hardships have created larger problems for the company. For one, Cineworld had to pay $170 million to shareholders who claimed the company had underpaid in its original buyout of Regal. The company is also facing a giant lawsuit from Cineplex, a company Cineworld offered to buy for $2.1 billion in December 2019 just ahead of the pandemic before out of the deal. Cineplex was awarded nearly $1 billion in a settlement agreement, which Cineworld is currently contesting in court.

The bigger problem is that Cineworld currently has nearly $9 billion in debt. 2020 didn't help matters, with the company losing $1.6 billion in the first half of the year alone. The financial picture is grim. Even with the box office rebounding, the crippling debt load, lawsuits, and poor credit score that results from all of these issues has wounded Regal. As of this writing, Cineworld's stock sits at a very poor 26 cents per share, with a market cap of around $392 million.

AMC Theatres

AMC is the largest theater chain in the U.S. by far, with around 946 theaters and 10,562 screens to its name. That metric alone gives the chain an edge in the game as they have more locations for moviegoers to access. But that also means more rent to be paid and more useless real estate to deal with during the shutdown of 2020. AMC suffered huge losses during the pandemic, and its debt load suffered as well. The company nearly went bankrupt and, as it stands, they have a debt load of around $5.5 billion.

The good news, though, is AMC is trying to climb out of the hole. The company recently purchased $72.5 million of its debt for a discounted $50 million, which will save on interest costs. It's like throwing a stone at a giant, but it's progress nevertheless. AMC also got a great deal of press last year for its "meme stock" run, with Redditors and other online investors targeting the stock, giving it a big boost ... though one that didn't last, admittedly. This was also tied to the Gamestop stock fiasco. As of this writing, AMC's stock sits at $14.50 per share, with a $7.34 billion market cap.

Also of note for AMC is that the company is diversifying its business well beyond the box office. They recently started selling popcorn in malls and, oddly enough, purchased a stake in a gold and silver mining company in Nevada. But diversification in business is often not a bad thing and finding new revenue streams to chip away at that mountain of debt is ultimately a good choice.

The Big Picture

Overall, it's not difficult to see how each company is faring in broad terms. Are both theater chains facing issues? Absolutely. Those are both gigantic debt loads and both companies narrowly escaped disaster in 2020 and 2021. However, Cineworld seems to be having bigger issues and, as a result, has a larger mountain of debut to go with less real estate in the U.S., meaning less potential for a larger market share. Not to mention the downright ugly stock price. Hence, generally speaking, less foot traffic.

Meanwhile, AMC has attempted to diversify its business coming out of the pandemic, has more screens to utilize for big hits that have been coming to theaters throughout the back half of 2021 and into 2022, and has been chipping away at its debt and maintaining a much better stock price. They're also making smart moves to find more customers, such as finally offering open captions for the deaf and hard of hearing. In opening up the larger picture, AMC seems to be better positioned to attract more moviegoers and can focus more on its core business.

Read this next: 13 Box Office Bombs That Are Truly Worth A Watch

The post How AMC Theaters Managed To Recover From The Pandemic Better Than Regal Cinemas appeared first on /Film.

from /Film https://ift.tt/fwh5ABJ

0 Comments

Please don't use vulgar comments and avoid discussion on Religious matters